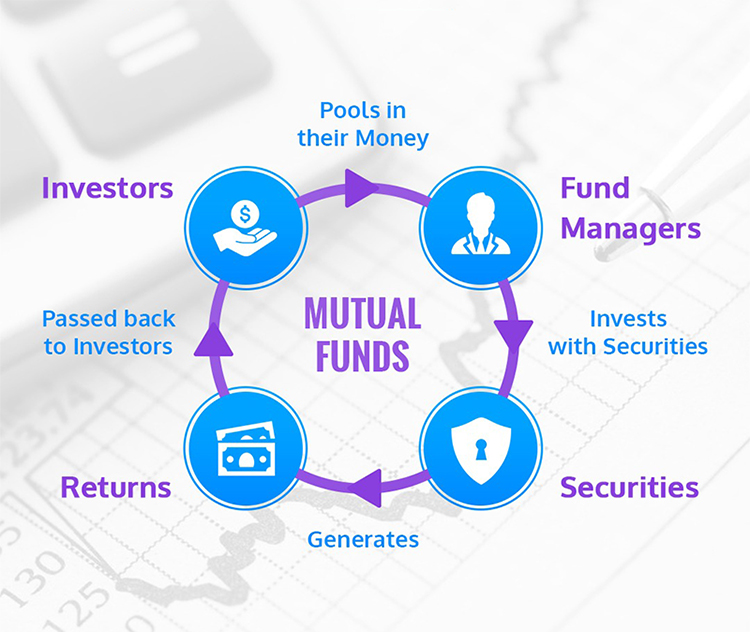

A Mutual fund is an investment vehicle in which a pool of investors collectively put forward funds to an investment manager to make investments on their behalf.

Minimum Investment

Investing in Mutual Funds doesn't require a large sum of money. You can start a monthly SIP with just Rs. 500.

Mutual Fund Schemes

Mutual fund schemes don't have a long lock-in period. You can withdraw money as per your requirement.

Highly Regulated

Market regulator SEBI oversees all mutual fund schemes in India. It issues strict guidelines that Asset management companies must follow while managing funds.

Equity

Equity Mutual funds have shown to generate returns which beat the inflation and therefore it is important to invest in mutual funds which beats inflation.

You can start a monthly SIP with just Rs.500.

SIP(SYSTEMATIC INVESTMENT PLAN)

A SIP is an investment mode through which you can invest in Mutual funds. As the term indicates, it is a systematic method of periodically investing fixed amounts of money. This can be monthly, quarterly or semi- annually etc. When you invest steadily in this manner, it can become easier to meet your financial goals.

Lumpsum

Lumpsum investment refers to investing a considerable amount in a Mutual fund scheme. In lumpsum investing, the money is deposited as a one-time down payment. Individuals who are having a large amount can deposit a significant proportion in Mutual funds. Lump-sum investment is ideal for long term tenure. You can withdraw this amount in regular intervals or let it compound over the years.

There are hundreds of funds and every fund has certain features and characteristics, making it highly confusing for the retail investor. This is where we come in.

Step 1

Drop us a message on Whatsapp or call us at 9959467203/9935689935.

Step 2

We will get in touch with you and get your KYC done.

Step 3

We will fix a meeting to understand your financial goals and investment objectives.

Step 4

Check your progress and all other updates from our Wealth Elite App easily from home.

Step 5

Call us in case of any query and we’ll be there.

Yes, your money is completely safe in Mutual funds.

- Regulatory Oversight- Mutual funds are regulated by the Securities and exchange board of India. It issues strict guidelines that AMC’S must follow while managing funds.

- Transparency- Mutual funds offer one of the most transparent and cost effective investment options to all categories of investors.

- Diversification- Mutual funds diversification also known as Asset Allocation, is a strategy that helps to manage risks in investment.